MOH had a good run but EPS estimates started slipping. I put a 4% trailing stop loss order in place. It triggered on Friday, +11.9%.

The SPY puts are still in place.

Sunday, September 20, 2015

Tuesday, September 15, 2015

LP RI OP on AMAG

Leerink Partners reiterates its outperform rating for AMAG. "there is a high likelihood that the [competitor's] drug is contraindicated for use in pregnant women". [Street Insider]

Monday, September 14, 2015

Watching MGR

I'll grab some more MGR if it hits my limit order this week. MGR is exchange traded debt issued by AMG (which hasn't fared quite as well) which pays a 6-3/8% dividend on $25 par value callable in August 2017. That gives it a present value of $28.19. It closed at $26.11 today.

[SA article]

[SA article]

EFOI ... Again

Saturday, September 12, 2015

More AMAG

I bought more AMAG yesterday when it was down 10.8% on news of debatable impact to AMAG (SeekingAlpha - read comments).

The SPY puts are still in place.

The SPY puts are still in place.

Friday, September 11, 2015

Updates, SEDG & AMAG

SEDG had great news on their new HD-Wave inverters (PV mag article), up 4.1% for the day.

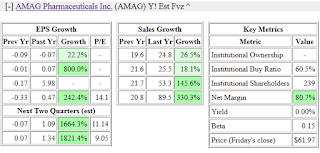

AMAG went down even more, -4.7%. With triple-digit quarterly revenue growth for the last three quarters and a forward P/E of 7.4 this looks like an easy buy. But EPS estimates were just revised down a few percent for the next two quarters, slightly reducing the estimates for this year and next. It's problematic if this becomes a trend.

MOH has been a steady performer without all the drama. Not cheap with a forward P/E of 22, but good growth projected for earnings and revenue.

I went short against the general market again with SPY puts.

AMAG went down even more, -4.7%. With triple-digit quarterly revenue growth for the last three quarters and a forward P/E of 7.4 this looks like an easy buy. But EPS estimates were just revised down a few percent for the next two quarters, slightly reducing the estimates for this year and next. It's problematic if this becomes a trend.

MOH has been a steady performer without all the drama. Not cheap with a forward P/E of 22, but good growth projected for earnings and revenue.

I went short against the general market again with SPY puts.

Wednesday, September 9, 2015

DFS Gone, Less SEDG

DFS was bought in anticipation of a Fed rate hike. Since purchase DFS has been mostly good at going down. The morning started off like a 2-day rally, and I was going to sell into it. When the market started to turn south I jettisoned the DFS shares, -11.2%.

Around the same time I also sold my highest priced (and smallest) lot of SEDG, -8.9%. I'm still overweight with SEDG shares so I haven't given up on them. Just reducing my exposure and the thrashing my portfolio takes when the market tanks. More money for cheaper shares later.

My top holdings are SEDG, AMAG, and INFN.

AMAG still looks really good though the EPS estimates are bouncing around a bit. But why buy when it keeps getting cheaper? I plan to add to my position before that train leaves the station.

Around the same time I also sold my highest priced (and smallest) lot of SEDG, -8.9%. I'm still overweight with SEDG shares so I haven't given up on them. Just reducing my exposure and the thrashing my portfolio takes when the market tanks. More money for cheaper shares later.

My top holdings are SEDG, AMAG, and INFN.

AMAG still looks really good though the EPS estimates are bouncing around a bit. But why buy when it keeps getting cheaper? I plan to add to my position before that train leaves the station.

Thursday, September 3, 2015

EFOI Gone, Puts Gone

I sold the EFOI position already, +10.6%. Too much too fast I think, plus a fair amount of negative sentiment.

I also sold the SPY puts. I was waiting for the opening rally to fade but had to bail while they were green. +2.0% for the large position, +0.3% for the small account. Next time I hope to get in earlier, and maybe sell earlier.

I also sold the SPY puts. I was waiting for the opening rally to fade but had to bail while they were green. +2.0% for the large position, +0.3% for the small account. Next time I hope to get in earlier, and maybe sell earlier.

Zig or Zag

Now comes the hard part - figuring out whether to stay short or go long.

Yesterday was a great day for longs. My SPY puts lost half their value. AMAG had a great day and SEDG did okay, both of which I trimmed the day before.

The SPY puts have worked great. My portfolio gained value all but one day (when my #2 position AMAG took a dive). It's reassuring to know you're making more money in a down market (provided your biggest positions only suffer modest losses). I wish I'd put them on two weeks earlier. But in a rally they puts the brakes on a rebound and are soon to be a losing position.

Screen:

I looked at some stocks that have been defying the market and came up with AXGN, TRVN, EZCH, EFOI and BEAT (charts). I could have bought TRVN when it was only up 3% (sigh). I ended up buying a starter position in EFOI when it was up 9% or so and still closed with a gain.

Yesterday was a great day for longs. My SPY puts lost half their value. AMAG had a great day and SEDG did okay, both of which I trimmed the day before.

The SPY puts have worked great. My portfolio gained value all but one day (when my #2 position AMAG took a dive). It's reassuring to know you're making more money in a down market (provided your biggest positions only suffer modest losses). I wish I'd put them on two weeks earlier. But in a rally they puts the brakes on a rebound and are soon to be a losing position.

Screen:

I looked at some stocks that have been defying the market and came up with AXGN, TRVN, EZCH, EFOI and BEAT (charts). I could have bought TRVN when it was only up 3% (sigh). I ended up buying a starter position in EFOI when it was up 9% or so and still closed with a gain.

Tuesday, September 1, 2015

Batten Down the Hatches

Today I gave up on a short term recovery. As much as I like the rebound prospects for my under water positions, I don't like the market. So to reduce exposure and raise cash I sold some of my highest priced (and smallest) lots and September calls.

First to go were some SEDG positions opened in June, -36.5%. Then I sold the quickly decaying time value in my Sept $25 calls, -83.4%. Yeah, those got away from me.

I sold the top lot of AMAG, -15.1%.

The SPY put options have worked well so far; up 49% and offsetting my stock losses. Now if I can only divine the bottom and shift gears before these puts smack me in the face.

First to go were some SEDG positions opened in June, -36.5%. Then I sold the quickly decaying time value in my Sept $25 calls, -83.4%. Yeah, those got away from me.

I sold the top lot of AMAG, -15.1%.

The SPY put options have worked well so far; up 49% and offsetting my stock losses. Now if I can only divine the bottom and shift gears before these puts smack me in the face.

Monday, August 31, 2015

Checking In

By now we all know Monday Aug. 24 opened badly. Unfortunately I had a tight stop on CSFL - the gap down took care of that. A 10% paper gain turned into a +0.05% keeper. Lesson learned. My orders are now only good for the day until things settle down.

On Wednesday I bought SWKS again. I sold it today, +6.8%.

On Friday I re-bought the top of my INFN pyramid for $21.86. That's the lot I'd sold earlier for $23.95.

In addition to the SWKS sale today, I also sold my EVHC that I held since May, +10.0%. Both were lower at the close.

Finally, I bought some Nov $190 SPY put options. Too many people I respect are calling for more weakness in the market.

On Wednesday I bought SWKS again. I sold it today, +6.8%.

On Friday I re-bought the top of my INFN pyramid for $21.86. That's the lot I'd sold earlier for $23.95.

In addition to the SWKS sale today, I also sold my EVHC that I held since May, +10.0%. Both were lower at the close.

Finally, I bought some Nov $190 SPY put options. Too many people I respect are calling for more weakness in the market.

Friday, August 21, 2015

BDSI SEDG INFN

On Wed. 8/12 the EPS estimates for BDSI were lowered again (significantly). This is not the sign of a market leader or a likely acquisition candidate. Recovery prospects look bleak. Sold, -48.0%.

Wednesday was a tough day for SEDG. I bought large lots below what I figured were trigger points for stop loss orders (-5, 8, 10%) placed the previous evening. SEDG's solar "peers" are facing headwinds and being punished, but SEDG is a core provider that I believe is insulated to some degree. With EPS estimates raised again, I'm grossly over-weighted in SEDG.

I put in a stop loss order for my top tranche of INFN. It triggered early yesterday morning leaving me with a +3.6% gain on that lot and an unrealized gain of 20%-plus for the larger lots. With more selling, perhaps partly related to newly acquired Transmode shareholders selling their shiny new INFN shares, INFN finished down 12.3% (and the DIA closing down 358 points). That left my remaining shares still in-the-money, but at risk. I don't plan on selling here. I also have October calls that are still ITM.

That leaves my other top holding AMAG. It has fallen through the uptrend line and appears to be in a healthy consolidation phase. I'm holding here.

On a side node, I'm so glad I ditched AKRX. They failed to report Q1 (among other restatements) again amid new Non-Compliance Notices.

Overall, this market is par for summer trading. I'll continue buying and looking ahead to September.

Wednesday was a tough day for SEDG. I bought large lots below what I figured were trigger points for stop loss orders (-5, 8, 10%) placed the previous evening. SEDG's solar "peers" are facing headwinds and being punished, but SEDG is a core provider that I believe is insulated to some degree. With EPS estimates raised again, I'm grossly over-weighted in SEDG.

I put in a stop loss order for my top tranche of INFN. It triggered early yesterday morning leaving me with a +3.6% gain on that lot and an unrealized gain of 20%-plus for the larger lots. With more selling, perhaps partly related to newly acquired Transmode shareholders selling their shiny new INFN shares, INFN finished down 12.3% (and the DIA closing down 358 points). That left my remaining shares still in-the-money, but at risk. I don't plan on selling here. I also have October calls that are still ITM.

That leaves my other top holding AMAG. It has fallen through the uptrend line and appears to be in a healthy consolidation phase. I'm holding here.

On a side node, I'm so glad I ditched AKRX. They failed to report Q1 (among other restatements) again amid new Non-Compliance Notices.

Overall, this market is par for summer trading. I'll continue buying and looking ahead to September.

Friday, August 7, 2015

More AMAG, INFN, and SEDG

Yesterday I added onto my AMAG and SEDG positions. Today it's INFN.

The tankers TNK and LPG might be good for a trade, but the growth flattens out next year so I'll just let my current positions run and capture the value of this year's growth.

NWHM missed so I'm looking for a little bounce to get out of that.

The tankers TNK and LPG might be good for a trade, but the growth flattens out next year so I'll just let my current positions run and capture the value of this year's growth.

NWHM missed so I'm looking for a little bounce to get out of that.

Wednesday, July 29, 2015

LPG & NWHM Opened

TNK Added

I added onto TNK Monday after estimates were raised going into next week's earning report.

I was a day early on my AMAG and SEDG buys Friday, and TNK's Monday. It's so much nicer having a bit of profit to work with rather than being under water 1 day out. But that's what you get buying in a market slump.

I was a day early on my AMAG and SEDG buys Friday, and TNK's Monday. It's so much nicer having a bit of profit to work with rather than being under water 1 day out. But that's what you get buying in a market slump.

Friday, July 24, 2015

AKRX Gone, Q2 ERs

I opted to sell AKRX and sit out its belated Q1 earnings report, +2.4%. It's basically a "do-over" with a bit of profit thrown in.

I bought more AMAG and SEDG. I'm pyramiding both - capping off AMAG with a small tranche, building the base of SEDG with a much larger one. These are my two largest positions by a large margin.

I think I called SWKS right. There's still growth there, but it's not the rocket ship it was. I'll keep an eye on the EPS estimates and wait for the dust to settle, but I'm out for now.

This was not a good week. Someday I'd like to sell DFS for a profit. Everything was down but INFN, which had a nice pop to new highs.

Holdings: AMAG BDSI CSFL DFS EVHC INFN MOH SEDG TNK

I bought more AMAG and SEDG. I'm pyramiding both - capping off AMAG with a small tranche, building the base of SEDG with a much larger one. These are my two largest positions by a large margin.

I think I called SWKS right. There's still growth there, but it's not the rocket ship it was. I'll keep an eye on the EPS estimates and wait for the dust to settle, but I'm out for now.

This was not a good week. Someday I'd like to sell DFS for a profit. Everything was down but INFN, which had a nice pop to new highs.

Holdings: AMAG BDSI CSFL DFS EVHC INFN MOH SEDG TNK

Friday, July 17, 2015

LCI Gone, INFN Expiry

Earlier this week I set a 4% trailing stop loss order under LCI which finally kicked me out above $60, +3.6%. Considering the loss I was staring at at one point, that's good.

My July INFN call options expired today. I priced them a smidgen too high and finally had to punt for a small loss, -3.0%. My October INFN calls are in good shape.

It was a good week with all but two stocks (LCI & SEDG) up for the week. More than half were up over 5% for the week.

My July INFN call options expired today. I priced them a smidgen too high and finally had to punt for a small loss, -3.0%. My October INFN calls are in good shape.

It was a good week with all but two stocks (LCI & SEDG) up for the week. More than half were up over 5% for the week.

Thursday, July 16, 2015

AKRX Opened

Yesterday I saw AKRN mentioned with LCI and took a look. Earnings as posted (and lagging) are growing, revenue has reached a new level with some growth projected. There's 80% institutional ownership with a 90% buy-side bias. It's a bit expensive P/E-wise but next year's forward P/E is 18.6. I opened a position.

Today I see that AKRN is late filing it's March 31 10-Q but just got a reprieve yesterday from Nasdaq. Personally I don't want to wait as late as Nov 9 to see how they did in Q1 ... at least not for this price (P/E). I think the stock has sold off enough to offer some protection and rebound potential, but I'll be proceeding carefully.

Funny how I checked for earnings disappointments (there were none) but missed the fact that all of Q1 was missing.

Today I see that AKRN is late filing it's March 31 10-Q but just got a reprieve yesterday from Nasdaq. Personally I don't want to wait as late as Nov 9 to see how they did in Q1 ... at least not for this price (P/E). I think the stock has sold off enough to offer some protection and rebound potential, but I'll be proceeding carefully.

Funny how I checked for earnings disappointments (there were none) but missed the fact that all of Q1 was missing.

Tuesday, July 14, 2015

SWKS Closed, Again

It still feels like SWKS is struggling to get to new highs. Earnings estimates are static, and will probably remain so until they report earnings on the 23rd.

I put in a limit sell order that took quite a while to fill. The position closed with a 5.6% gain in less than a week. That's a year's gain for some asset classes so I'm happy with my modest (but quick) gain from gambling on an oversold bounce.

With earnings estimates mostly locked in I'm not scanning for new opportunities; but rather waiting for the earnings reports to come in. Less gamble, more visibility.

I put in a limit sell order that took quite a while to fill. The position closed with a 5.6% gain in less than a week. That's a year's gain for some asset classes so I'm happy with my modest (but quick) gain from gambling on an oversold bounce.

With earnings estimates mostly locked in I'm not scanning for new opportunities; but rather waiting for the earnings reports to come in. Less gamble, more visibility.

Saturday, July 11, 2015

Friday, July 10, 2015

Moving Up?

I picked up some more INFN call options when it gapped up, slid back down and filled my order, then resumed the march up.

SEDG had an awesome 14% gain today which recouped a chunk of my losses. SEDG is once again my biggest position. My intention is (or maybe was) to keep building my position at these lower prices and sell off the higher priced lots when the next run fades.

SWKS moved up 6% which was nice as well.

We'll see what next week brings.

SEDG had an awesome 14% gain today which recouped a chunk of my losses. SEDG is once again my biggest position. My intention is (or maybe was) to keep building my position at these lower prices and sell off the higher priced lots when the next run fades.

SWKS moved up 6% which was nice as well.

We'll see what next week brings.

Wednesday, July 8, 2015

SWKS, more SEDG

Ouch!

Yesterday's session was brutal. Too bad I didn't hold off until 1130 (edst) to buy. But it looked like the tide was turning earlier - nice fake out. I could have got my INFN for almost 5% less.

I'm getting killed on SEDG which was my biggest position, now well behind AMAG. But SEDG's earnings estimates are holding and the P/Es have dropped, so I'll add more chunks and shore up the foundation a bit.

I'm getting killed on SEDG which was my biggest position, now well behind AMAG. But SEDG's earnings estimates are holding and the P/Es have dropped, so I'll add more chunks and shore up the foundation a bit.

Tuesday, July 7, 2015

Monday, July 6, 2015

Monday, June 29, 2015

More AMAG & Shopping List

Someone's market sell order found my cheap limit buy order at the open so I picked up more AMAG at the low of the day. Up over 5% on that lot ... nice if it holds. AMAG is still in the channel and closing above the 50-day SMA.

INFN is now at the bottom of its channel and above its 50-day SMA. If it holds, I'm buying more.

SWKS dropped out of a long-term pennant pattern today. The forecasts are predicting decelerating revenue and earnings. I'm going to wait for the price to reflect diminished expectations, or perhaps for the next earnings report (Jul 23?) and some fresh guidance.

INFN is now at the bottom of its channel and above its 50-day SMA. If it holds, I'm buying more.

SWKS dropped out of a long-term pennant pattern today. The forecasts are predicting decelerating revenue and earnings. I'm going to wait for the price to reflect diminished expectations, or perhaps for the next earnings report (Jul 23?) and some fresh guidance.

Thursday, June 25, 2015

CSFL INFN

INFN hit the 6% trailing stop selling my highest price lot, which was just over half my position, +9.8%. The market seems a bit soft here so I'll see if I can't rebuy those shares after a bit more consolidation, or a least some demonstrated support at this level.

CSFL has run strong and is well outside of its channel so I opted to take some profit and sold a bit over half the position, +9.1%. I plan to rebuy at a lower price should CSFL return to its normal trading range/channel.

CSFL has run strong and is well outside of its channel so I opted to take some profit and sold a bit over half the position, +9.1%. I plan to rebuy at a lower price should CSFL return to its normal trading range/channel.

Tuesday, June 23, 2015

Yet Another Growth Screen

Friday, June 19, 2015

Tuesday, June 16, 2015

Thou Shalt Not Give Back

I hate to watch a gain turn into a loss. So when a position has a reasonable margin, I put in a stop loss order in case it heads south. That can be a little short sighted I know.

Peter Lynch said if he used 7% stop loss orders he'd have nothing to show but a portfolio of 7% losses. In my defense I have to balance the fact that I often buy on strength, and at the top. Sometimes that's just in time for a correction. Getting stopped out gives me a chance to do more research, re-evaluate my opinion, and re-enter the stock if warranted, hopefully at a lower price.

Anyway, here's the latest ...

EBS spiked down an triggered the SL order, +2.0%. I see this as fairly valued with a forward P/E of 18.6 and a lot of variability in the growth projections. I won't be re-entering near term.

AMAG hit the tripwire too, selling half my position, +0.61%. The intent here is was to lock in some profit and reposition lower in the event of a correction. AMAG is one of my favorites now and I'll be restoring that lot or even adding-on given the opportunity.

Peter Lynch said if he used 7% stop loss orders he'd have nothing to show but a portfolio of 7% losses. In my defense I have to balance the fact that I often buy on strength, and at the top. Sometimes that's just in time for a correction. Getting stopped out gives me a chance to do more research, re-evaluate my opinion, and re-enter the stock if warranted, hopefully at a lower price.

Anyway, here's the latest ...

EBS spiked down an triggered the SL order, +2.0%. I see this as fairly valued with a forward P/E of 18.6 and a lot of variability in the growth projections. I won't be re-entering near term.

AMAG hit the tripwire too, selling half my position, +0.61%. The intent here is was to lock in some profit and reposition lower in the event of a correction. AMAG is one of my favorites now and I'll be restoring that lot or even adding-on given the opportunity.

Thursday, June 11, 2015

SEDG Opened

Monday, June 8, 2015

Thursday, June 4, 2015

LCI Calls, SWKS Sold

My June LCI calls had more time value than potential to make up the difference in the next two weeks I thought, so I sold them this morning. LCI never recovered from the post-earnings gap down leaving me with a loss, -70.8%. I still have shares, but there's no rush to close the position while LCI is clawing its way back up.

SWKS hit the 6% trailing stop when it gapped down at the open, +8.27%. It's not my intention to trade SWKS given the constant upward revisions to its earnings estimates, but neither is it my intention to watch gains turn into losses. Hopefully I can get back on board at a lower price like the last time.

SWKS hit the 6% trailing stop when it gapped down at the open, +8.27%. It's not my intention to trade SWKS given the constant upward revisions to its earnings estimates, but neither is it my intention to watch gains turn into losses. Hopefully I can get back on board at a lower price like the last time.

Wednesday, June 3, 2015

SNCR - Sold the Rumor

I executed and sold my June SNCR calls this morning, +51.6%. It popped in response to a buyout rumor. I'm in no position to speculate with no insight into the company, so no call spreads or holding out for a better price. A bird in hand if you will.

Saturday, May 30, 2015

ODFL & SNCR Shares Sold

Saturday, May 23, 2015

UBNT Gone

UBNT poked its head above water, hit my limit order and is gone. +0.4%.

UBNT was such a darling when I started down this road. But disappointment after disappointment, and now EPS estimates continue to be revised downward.This tranche was only the latest - some big winning trades followed by substantial losses leaves me with modest gain. (I actually expected it to be a lot worse when I started to tally the results.)

UBNT was such a darling when I started down this road. But disappointment after disappointment, and now EPS estimates continue to be revised downward.This tranche was only the latest - some big winning trades followed by substantial losses leaves me with modest gain. (I actually expected it to be a lot worse when I started to tally the results.)

Thursday, May 21, 2015

NICE Sold, EVHC Bought

My buy order for EVHC filled.

I opted to sell NICE as it was dropping, before it hit my stop.+10.8% plus dividends since 3/2/15.

NICE Systems YoY quarterly revenue growth is about to improve to 10%, with next year's earnings estimate giving it a forward P/E of 18.6. Institutions are net sellers. None of that is very compelling. It had a good run, it's time to go.

I opted to sell NICE as it was dropping, before it hit my stop.+10.8% plus dividends since 3/2/15.

NICE Systems YoY quarterly revenue growth is about to improve to 10%, with next year's earnings estimate giving it a forward P/E of 18.6. Institutions are net sellers. None of that is very compelling. It had a good run, it's time to go.

AMAG CSFL MOH Stats

Here are my tables for my last three purchases. These show quarterly year-over-year growth and the forward P/E 3 and six months out.

Wednesday, May 20, 2015

-BLKB and Revenue Growth Screen

BLKB just hit the stop, +14.6% since 3/2/15.

I am in the process of buying AMAG CSFL and MOH based on a revenue growth with falling P/E trend. Here is the raw screen on finviz. I'll filter these a bit more and provide more data later. I think CSFL and MOH represent solid diversity holdings for my tech heavy portfolio.

I am in the process of buying AMAG CSFL and MOH based on a revenue growth with falling P/E trend. Here is the raw screen on finviz. I'll filter these a bit more and provide more data later. I think CSFL and MOH represent solid diversity holdings for my tech heavy portfolio.

Tuesday, May 19, 2015

BRCD Gone

BRCD was short on revenue growth for me and institutions were biased to the sell side so I snugged up the trailing stop loss order to take advantage of the recent rebound. It popped a bit at the open before drifting into my sell order. -2.0%. Risk/reward-wise I think I'm ahead by selling now.

Monday, May 18, 2015

Saturday, May 16, 2015

EPS Up!

Here are my latest bright ideas. (Finviz screen)

Basically, I want stocks with EPS estimates frequently being revised upward, and strong year-over-year revenue growth.

My best candidate in that regard has been SWKS. It's been basing for 10 weeks now, but EPS estimates continue to grind upward.

EBS estimates for next Q just jumped up so I bought more shares before everyone notices how low the forward P/E is.

INFN also has good metrics and should reflect that in the chart at some point.

SNCR had a price reset recently and represents a good value. I think I'll buy some call options here.

SLAB, NICE, and BLKB were bought using different criteria, and I never expected that NICE and BLKB to perform as well as they have. Trailing stop loss orders are in place to lock in profits when they start to fade.

BRCD and UBNT are on the chopping block.

I own all of these stocks.

Basically, I want stocks with EPS estimates frequently being revised upward, and strong year-over-year revenue growth.

My best candidate in that regard has been SWKS. It's been basing for 10 weeks now, but EPS estimates continue to grind upward.

EBS estimates for next Q just jumped up so I bought more shares before everyone notices how low the forward P/E is.

INFN also has good metrics and should reflect that in the chart at some point.

SNCR had a price reset recently and represents a good value. I think I'll buy some call options here.

SLAB, NICE, and BLKB were bought using different criteria, and I never expected that NICE and BLKB to perform as well as they have. Trailing stop loss orders are in place to lock in profits when they start to fade.

BRCD and UBNT are on the chopping block.

I own all of these stocks.

May 15 Expiry Recap

May options have closed and my option bets on Q1 earnings missed.

The bottom fell out of LCI, and after selling the April calls against mine and selling the May calls for too much(*), the position still closed down, -66.2%. I still own June $55 calls and stock.

INFN failed to impress, after spreading the calls, -36.2%.

Finally, ODFL faded. After spreading, -8.0%.

* I had a limit sell order in for my LCI May $54 calls. The share price fell leaving me way overpriced. Fortunately for me, someone's market buy order got away from them and I was there to fill it. Sometimes the ask really is the ask. Careful with those market orders on low volume issues!

The bottom fell out of LCI, and after selling the April calls against mine and selling the May calls for too much(*), the position still closed down, -66.2%. I still own June $55 calls and stock.

INFN failed to impress, after spreading the calls, -36.2%.

Finally, ODFL faded. After spreading, -8.0%.

* I had a limit sell order in for my LCI May $54 calls. The share price fell leaving me way overpriced. Fortunately for me, someone's market buy order got away from them and I was there to fill it. Sometimes the ask really is the ask. Careful with those market orders on low volume issues!

Friday, May 1, 2015

Buying INFN LCI SWKS

Tuesday, April 28, 2015

Monday, April 27, 2015

More Carnage - CELG & SNCR Gone

CELG and SNCR hit their 8% TSL orders, -7.8, +2.3% respectively.

LCI got knocked down 8.2% - that's not good for a long option position.

Other stock holdings hit: UBNT, BDSI down > 4.2%, MDVN down 3.4%.

The good news? I'm raising cash!

LCI got knocked down 8.2% - that's not good for a long option position.

Other stock holdings hit: UBNT, BDSI down > 4.2%, MDVN down 3.4%.

The good news? I'm raising cash!

Friday, April 24, 2015

BIIB gone, long UBNT

BIIB missed and hit the 8% TSL. -7.5%, opened 4/9. It's been a rough week for earnings.

I have bids in for UBNT calls.

Update:

NXPI and IDTI both hit the 8% TSL triggers. -7.3% and -7.6% respectively. Brutal day for semis.

There were no nibbles on my UBNT call order - I was expecting another dip. Too bad - what an awesome recovery.

INFN had a good day for a tech stock. Glad to be out of TRN!

I have bids in for UBNT calls.

Update:

NXPI and IDTI both hit the 8% TSL triggers. -7.3% and -7.6% respectively. Brutal day for semis.

There were no nibbles on my UBNT call order - I was expecting another dip. Too bad - what an awesome recovery.

INFN had a good day for a tech stock. Glad to be out of TRN!

Thursday, April 23, 2015

SBS Gone, More INFN, UBNT?

Wednesday, April 22, 2015

INFN TRN

INFN reported yesterday, earnings were 16 c/sh vs est of 11c/sh (+45%), and beat the revenue estimate slightly.

TRN may have more litigation ahead. I've been long TRN since the last scare and I'm still underwater. I may have to throw in the towel and wait for a bottom.

Update

1/3 of my DFS shares sold (highest cost basis). -10.2%, opened 12/2/2014.

TRN triggered two stop loss orders. -24.5%, opened 9/17/2014 on. Sigh ...

TRN may have more litigation ahead. I've been long TRN since the last scare and I'm still underwater. I may have to throw in the towel and wait for a bottom.

Update

1/3 of my DFS shares sold (highest cost basis). -10.2%, opened 12/2/2014.

TRN triggered two stop loss orders. -24.5%, opened 9/17/2014 on. Sigh ...

Tuesday, April 21, 2015

+INFN -LRCX

Sunday, April 19, 2015

Thursday, April 16, 2015

PANW Closed, SDRL Gone

My April PANW call spread sold today, +28.8%. Position opened 4/1.

The short leg of the LCI spread will likely expire worthless (< $70) so I'll have another month to play with it.

I own no shares of either equity at the moment.

My SDRL shares sold when my 5% TSL order triggered, +16.1%. Position opened 4/9.

The short leg of the LCI spread will likely expire worthless (< $70) so I'll have another month to play with it.

I own no shares of either equity at the moment.

My SDRL shares sold when my 5% TSL order triggered, +16.1%. Position opened 4/9.

Wednesday, April 15, 2015

Back in 5

Not really. Anyway ...

I spread my March SWKS calls with both legs expiring ITM for nice +616.6% gain.

For April expiration, I spread my PANW calls for a $130/$140 bull call spread.

I did a calendar spread for my LCI May $50s with Apr $70s which are now just ITM.

I also bought May ODFL calls which are biding their time apparently.

Older holdings faring well: BLKB SNCR. I'm almost above water again with UBNT (finally).

Recent Options Action

I spread my March SWKS calls with both legs expiring ITM for nice +616.6% gain.

For April expiration, I spread my PANW calls for a $130/$140 bull call spread.

I did a calendar spread for my LCI May $50s with Apr $70s which are now just ITM.

I also bought May ODFL calls which are biding their time apparently.

Stocks

My last watchlist binge was on BIIB LCRX ODFL NXPI SBS and SDRL. SDRL has had a good run - everything else, not so much.Older holdings faring well: BLKB SNCR. I'm almost above water again with UBNT (finally).

Subscribe to:

Posts (Atom)