These two hit trailing stops and are gone. ODFL -8.2%, SNCR -1.41%. I still have June calls for SNCR.

The rest did fairly well on balance.

Saturday, May 30, 2015

Saturday, May 23, 2015

UBNT Gone

UBNT poked its head above water, hit my limit order and is gone. +0.4%.

UBNT was such a darling when I started down this road. But disappointment after disappointment, and now EPS estimates continue to be revised downward.This tranche was only the latest - some big winning trades followed by substantial losses leaves me with modest gain. (I actually expected it to be a lot worse when I started to tally the results.)

UBNT was such a darling when I started down this road. But disappointment after disappointment, and now EPS estimates continue to be revised downward.This tranche was only the latest - some big winning trades followed by substantial losses leaves me with modest gain. (I actually expected it to be a lot worse when I started to tally the results.)

Thursday, May 21, 2015

NICE Sold, EVHC Bought

My buy order for EVHC filled.

I opted to sell NICE as it was dropping, before it hit my stop.+10.8% plus dividends since 3/2/15.

NICE Systems YoY quarterly revenue growth is about to improve to 10%, with next year's earnings estimate giving it a forward P/E of 18.6. Institutions are net sellers. None of that is very compelling. It had a good run, it's time to go.

I opted to sell NICE as it was dropping, before it hit my stop.+10.8% plus dividends since 3/2/15.

NICE Systems YoY quarterly revenue growth is about to improve to 10%, with next year's earnings estimate giving it a forward P/E of 18.6. Institutions are net sellers. None of that is very compelling. It had a good run, it's time to go.

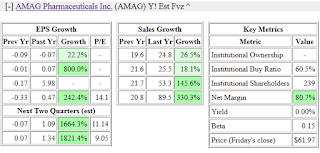

AMAG CSFL MOH Stats

Here are my tables for my last three purchases. These show quarterly year-over-year growth and the forward P/E 3 and six months out.

Wednesday, May 20, 2015

-BLKB and Revenue Growth Screen

BLKB just hit the stop, +14.6% since 3/2/15.

I am in the process of buying AMAG CSFL and MOH based on a revenue growth with falling P/E trend. Here is the raw screen on finviz. I'll filter these a bit more and provide more data later. I think CSFL and MOH represent solid diversity holdings for my tech heavy portfolio.

I am in the process of buying AMAG CSFL and MOH based on a revenue growth with falling P/E trend. Here is the raw screen on finviz. I'll filter these a bit more and provide more data later. I think CSFL and MOH represent solid diversity holdings for my tech heavy portfolio.

Tuesday, May 19, 2015

BRCD Gone

BRCD was short on revenue growth for me and institutions were biased to the sell side so I snugged up the trailing stop loss order to take advantage of the recent rebound. It popped a bit at the open before drifting into my sell order. -2.0%. Risk/reward-wise I think I'm ahead by selling now.

Monday, May 18, 2015

Saturday, May 16, 2015

EPS Up!

Here are my latest bright ideas. (Finviz screen)

Basically, I want stocks with EPS estimates frequently being revised upward, and strong year-over-year revenue growth.

My best candidate in that regard has been SWKS. It's been basing for 10 weeks now, but EPS estimates continue to grind upward.

EBS estimates for next Q just jumped up so I bought more shares before everyone notices how low the forward P/E is.

INFN also has good metrics and should reflect that in the chart at some point.

SNCR had a price reset recently and represents a good value. I think I'll buy some call options here.

SLAB, NICE, and BLKB were bought using different criteria, and I never expected that NICE and BLKB to perform as well as they have. Trailing stop loss orders are in place to lock in profits when they start to fade.

BRCD and UBNT are on the chopping block.

I own all of these stocks.

Basically, I want stocks with EPS estimates frequently being revised upward, and strong year-over-year revenue growth.

My best candidate in that regard has been SWKS. It's been basing for 10 weeks now, but EPS estimates continue to grind upward.

EBS estimates for next Q just jumped up so I bought more shares before everyone notices how low the forward P/E is.

INFN also has good metrics and should reflect that in the chart at some point.

SNCR had a price reset recently and represents a good value. I think I'll buy some call options here.

SLAB, NICE, and BLKB were bought using different criteria, and I never expected that NICE and BLKB to perform as well as they have. Trailing stop loss orders are in place to lock in profits when they start to fade.

BRCD and UBNT are on the chopping block.

I own all of these stocks.

May 15 Expiry Recap

May options have closed and my option bets on Q1 earnings missed.

The bottom fell out of LCI, and after selling the April calls against mine and selling the May calls for too much(*), the position still closed down, -66.2%. I still own June $55 calls and stock.

INFN failed to impress, after spreading the calls, -36.2%.

Finally, ODFL faded. After spreading, -8.0%.

* I had a limit sell order in for my LCI May $54 calls. The share price fell leaving me way overpriced. Fortunately for me, someone's market buy order got away from them and I was there to fill it. Sometimes the ask really is the ask. Careful with those market orders on low volume issues!

The bottom fell out of LCI, and after selling the April calls against mine and selling the May calls for too much(*), the position still closed down, -66.2%. I still own June $55 calls and stock.

INFN failed to impress, after spreading the calls, -36.2%.

Finally, ODFL faded. After spreading, -8.0%.

* I had a limit sell order in for my LCI May $54 calls. The share price fell leaving me way overpriced. Fortunately for me, someone's market buy order got away from them and I was there to fill it. Sometimes the ask really is the ask. Careful with those market orders on low volume issues!

Friday, May 1, 2015

Buying INFN LCI SWKS

Subscribe to:

Posts (Atom)