A nice finish closed out the month to the plus side. DNS +68, +13, +10.

Trades: none.

Reversal alerts: (18). ANF DRYS & OPLK jump out with the best earnings growth. CRZO is worth looking at too.

Monday, January 31, 2011

Got Growth?

Who's got triple digit YoY quarterly sale growth for the last three quarters that will increase their yearly earnings by 50% or more over the next two quarters?

Relaxing the triple digit sales growth to only the last two quarters adds: SOL LDK PWER CLF RES TTMI ASYS SWK & PVH.

| Stock | Current - Forward P/E |

|---|---|

| VECO | 9.9 - 6.2 |

| JKS | 23 - 6.8 |

| RTEC | 27 - 9.5 |

| AEIS | 18.3 - 10.6 |

| RBCN | 33.8 - 12.2 |

| SPRD | 27.8 - 14.0 |

| NOG | 131 - 55.7 |

Relaxing the triple digit sales growth to only the last two quarters adds: SOL LDK PWER CLF RES TTMI ASYS SWK & PVH.

Friday, January 28, 2011

Blame Egypt

That was the excuse for today's plummet. Whatever. DNS -166, -68, -23.

Trades:

I got nervous as UA started drifting down and the market started losing ground. I barely finished entering a stop loss order before it filled (+6.61%). UA managed to close just below my sell point. I kept the call options in place.

I sold an in-the-money call on IMAX to recoup some of the loss and convert to a bull call spread.

I entered a bunch of bullish positions that were Schaeffer recommendations. Bought six calls, sold one put. Not the best timing.

Reversal alerts: (9) of which DRYS DXPE OPLK and SNI are interesting for one reason or another.

The value-sales port was up considerably before today. Now +45.4%.

Trades:

I got nervous as UA started drifting down and the market started losing ground. I barely finished entering a stop loss order before it filled (+6.61%). UA managed to close just below my sell point. I kept the call options in place.

I sold an in-the-money call on IMAX to recoup some of the loss and convert to a bull call spread.

I entered a bunch of bullish positions that were Schaeffer recommendations. Bought six calls, sold one put. Not the best timing.

Reversal alerts: (9) of which DRYS DXPE OPLK and SNI are interesting for one reason or another.

|

| Value-sales portfolio, +45.4% |

Thursday, January 27, 2011

Mixed Day

It was a great day if you owned NFLX UA PTEN BRKS or AMAT. Otherwise, meh. DNS +4, +16, +3. (Update: add to that list AMED MU UDRL QCOM NCTY and AMZN.)

Trades:

I saw UA was up. Read news. Saw cotton. Went "BUY BUT BUY!". Stock and more call options. I even got in at the low of the day (under $56). Ca-ching!

Reversal alerts: (37) but really nothing of interest here. AIRM again and PX. Two decent Nasdaq days are just churning up the crud at the bottom - hence all the alerts.

Trades:

I saw UA was up. Read news. Saw cotton. Went "BUY BUT BUY!". Stock and more call options. I even got in at the low of the day (under $56). Ca-ching!

Reversal alerts: (37) but really nothing of interest here. AIRM again and PX. Two decent Nasdaq days are just churning up the crud at the bottom - hence all the alerts.

Wednesday, January 26, 2011

That's More Like It

Today we had solid gains across a broad spectrum of stocks. DNS +8, +20, +5.

Trades:

Stock SSW triggered the trailing stop loss order, +5.49%.

I bought ANR.

Reversal alerts: (41) filtered (for growth and value) down to MALL NEWP EBS LUV AIMC CROX IBI & TIF.

The best mix of chart patterns and fundamentals are: NEWP SCHN AIRM ASF BVN EVS MSM & TIF.

Trades:

Stock SSW triggered the trailing stop loss order, +5.49%.

I bought ANR.

Reversal alerts: (41) filtered (for growth and value) down to MALL NEWP EBS LUV AIMC CROX IBI & TIF.

The best mix of chart patterns and fundamentals are: NEWP SCHN AIRM ASF BVN EVS MSM & TIF.

Tuesday, January 25, 2011

Mostly Cash

Two small IRA accounts are all cash, the big one is 66% cash, and the options account is 82% cash.

Trades:

The stop loss orders sold most of PAAS (-16.45%) and all of PVH (-4.20%) XLE (+3.17) and VALE (+4.87).

I sold call options NEWP (-1.58%) PTEN (-4.66%) and XLE (+29.2%).

Reversal alerts: (12) unfiltered t2: CHG FARM HQS. hlr: APP BWLD CNXT DMND FRO PX PXG ULTA VTAL.

Trades:

The stop loss orders sold most of PAAS (-16.45%) and all of PVH (-4.20%) XLE (+3.17) and VALE (+4.87).

I sold call options NEWP (-1.58%) PTEN (-4.66%) and XLE (+29.2%).

Reversal alerts: (12) unfiltered t2: CHG FARM HQS. hlr: APP BWLD CNXT DMND FRO PX PXG ULTA VTAL.

Batten Down the Hatches

The futures look bad so I'm going defensive here. Most of my trailing stop loss orders have been replaced by tight stop loss orders. For those positions that survive the open, the stop loss orders will allow some wiggle room to the upside. Limit orders are in for most of my call options. G'luck!

Stock Ideas

Monday, January 24, 2011

Don't Take the Bait

Today's rebound was nice but not strong enough after last week's sell-off to convince me that the rally has resumed. I'm going to exercise caution here.

Trades: I sold ANR, LULU, and RES shares acquired from in-the-money bull call spreads. I've updated Friday's post with the gains & losses.

I'm sure glad some positions sold early because watching my stocks fade going into expiration wasn't fun. I went from licking my chops as I anticipated a nice profit, to damage control. That's option trading - not for the faint of heart.

Reversal alerts: (19). Here we have a bunch of value stocks with a forward P/E below 30. In order of forward P/E (ascending): AMED ORRF SMP ENSG PRK CHE ESE SNHY & HUBG.

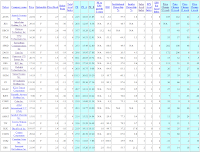

Here's my watch list sorted by 2-week performance. Too much red.

Trades: I sold ANR, LULU, and RES shares acquired from in-the-money bull call spreads. I've updated Friday's post with the gains & losses.

I'm sure glad some positions sold early because watching my stocks fade going into expiration wasn't fun. I went from licking my chops as I anticipated a nice profit, to damage control. That's option trading - not for the faint of heart.

Reversal alerts: (19). Here we have a bunch of value stocks with a forward P/E below 30. In order of forward P/E (ascending): AMED ORRF SMP ENSG PRK CHE ESE SNHY & HUBG.

Here's my watch list sorted by 2-week performance. Too much red.

Friday, January 21, 2011

Pop 'n' Fizzle

The markets started strong, then went south. DNS +49, -15, +3.

Trades:

I bought WLL shares again.

WFR hit its trailing stop. -2.31%

I sold Shaeffer recommendation OPEN call options after a long term holding period of one day. +32.3%

Options closing today (bull call spreads except SKX):

SKX -100%

ANR +52.7%

LULU -38.0% [Shaeffer reco]

RES -30.3% net for all three spreads

VECO +42.9% less commissions.

That was a very disappointing finish for energy stocks ANR and RES after being deep in the money for so long. Overall though it's been a very good 30 days. There was a lot of selling to protect profits and capital and some scrambles to repair trades, but that's half the game sometimes (and sometimes more).

Reversal alerts: (27).

CAB has held up the best here, but STMP DRYS & NTRI all have some earnings growth and good P/Es. None have had significant sales growth recently (check estimates though), and the last three have sold off pretty hard. DRYS is shedding some heavy losses and sustaining a new profit level that will drop its P/E to around 5. It would be my pick if the the markets were to shape up, especially on news of economic recovery.

It's been a tough week for the value-sales port as it dropped 12%.

Trades:

I bought WLL shares again.

WFR hit its trailing stop. -2.31%

I sold Shaeffer recommendation OPEN call options after a long term holding period of one day. +32.3%

Options closing today (bull call spreads except SKX):

SKX -100%

ANR +52.7%

LULU -38.0% [Shaeffer reco]

RES -30.3% net for all three spreads

VECO +42.9% less commissions.

That was a very disappointing finish for energy stocks ANR and RES after being deep in the money for so long. Overall though it's been a very good 30 days. There was a lot of selling to protect profits and capital and some scrambles to repair trades, but that's half the game sometimes (and sometimes more).

Reversal alerts: (27).

CAB has held up the best here, but STMP DRYS & NTRI all have some earnings growth and good P/Es. None have had significant sales growth recently (check estimates though), and the last three have sold off pretty hard. DRYS is shedding some heavy losses and sustaining a new profit level that will drop its P/E to around 5. It would be my pick if the the markets were to shape up, especially on news of economic recovery.

|

| Value-sales portfolio +44.5% |

Thursday, January 20, 2011

More Red

Unless you just bought EBAY, you probably didn't have fun today.

More trades: In addition to the post below, SMTC hit the trailing stops. -3.43% and -4.02%

Reversal alerts: (10). Family Dollar Stores (FDO) is my pick here. You may want to watchlist ABV, AZZ, & FRED in case they start moving higher. Most have reasonable valuation with modest sales growth.

More trades: In addition to the post below, SMTC hit the trailing stops. -3.43% and -4.02%

Reversal alerts: (10). Family Dollar Stores (FDO) is my pick here. You may want to watchlist ABV, AZZ, & FRED in case they start moving higher. Most have reasonable valuation with modest sales growth.

-CF -VSEA

DNS -17 -17 -5 (intraday).

CF shares sold when the price gapped below the trailing stop loss price. +7.02%

VSEA shares hit their TSL too. +28.7%

None of the stop loss orders for calls triggered. Way too much drama the day before expiration.

CF shares sold when the price gapped below the trailing stop loss price. +7.02%

VSEA shares hit their TSL too. +28.7%

None of the stop loss orders for calls triggered. Way too much drama the day before expiration.

Wednesday, January 19, 2011

Sea of Red

Not a pretty day in the markets. DNS -13, -40, -13.

If the market opens down tomorrow the trailing stop loss order will start firing off and move me into cash.

Trades:

After yesterday's run I snugged up the TSL order on YGE to 4% - it triggered early this morning. +10.24%

A stop loss order for WFR call options triggered. +20.9%

Since the market seemed to be moving against us, I sold Shaeffer pick ENTR (Jan call) while it was still positive. +2.16%

I bought PAAS stock. Held off on buying calls until we see what tomorrow (or the next day) brings.

Reversal alerts: (9). ANF, LPL, and NAT are familiar but not very compelling. MALL is probably the best here value and growth-wise but the chart is iffy.

If the market opens down tomorrow the trailing stop loss order will start firing off and move me into cash.

Trades:

After yesterday's run I snugged up the TSL order on YGE to 4% - it triggered early this morning. +10.24%

A stop loss order for WFR call options triggered. +20.9%

Since the market seemed to be moving against us, I sold Shaeffer pick ENTR (Jan call) while it was still positive. +2.16%

I bought PAAS stock. Held off on buying calls until we see what tomorrow (or the next day) brings.

Reversal alerts: (9). ANF, LPL, and NAT are familiar but not very compelling. MALL is probably the best here value and growth-wise but the chart is iffy.

Tuesday, January 18, 2011

+/- 2.5% Day

It seems that half my stocks were either up 2.5% or down by the same amount.

CSTR came back some today. I'll probably buy call options on it if it holds.

YGE had a good day. I just wish I owned call options in addition to stock.

Trades: None except Shaeffer recommendations which I won't divulge until I close the positions.

Reversal alerts: (28) total.

Let's see, PAAS is the strongest here with triple digit sales and earnings growth estimates, P/E falling to 28, rising earnings estimates, and good analyst sentiment. It's on my shopping list.

Also of interest: MSM, NNN, BW, & BVN because of good chart patterns and reasonable fundamentals.

CSTR came back some today. I'll probably buy call options on it if it holds.

YGE had a good day. I just wish I owned call options in addition to stock.

Trades: None except Shaeffer recommendations which I won't divulge until I close the positions.

Reversal alerts: (28) total.

Let's see, PAAS is the strongest here with triple digit sales and earnings growth estimates, P/E falling to 28, rising earnings estimates, and good analyst sentiment. It's on my shopping list.

Also of interest: MSM, NNN, BW, & BVN because of good chart patterns and reasonable fundamentals.

Friday, January 14, 2011

Nice Friday Rally

CSTR - Oops

So much for the upside potential of CSTR versus BIDU. Down 23+% now.

I did buy some Jan $40 CSTR calls near the bottom earlier - they're nicely in the money. Update: now sold after drifting back into a stop loss/limit order, +24.25%.

ANR dropped again and triggered the trailing stop loss orders. +14.48% and -2.24%.

My limit order for a $20 Jan CF call spread sold for $19.95. +35.3%

I did buy some Jan $40 CSTR calls near the bottom earlier - they're nicely in the money. Update: now sold after drifting back into a stop loss/limit order, +24.25%.

ANR dropped again and triggered the trailing stop loss orders. +14.48% and -2.24%.

My limit order for a $20 Jan CF call spread sold for $19.95. +35.3%

Thursday, January 13, 2011

No Follow Through

One good day does not deserve another apparently.

Trades: FMCN nudged into the money. With the options expiring in eight days I could:

a) see if the breakout continues,

b) take the money (*) and run.

I chose B. Any profit is better than any loss, and I'm not here to gamble. I've got enough other positions where I can anticipate gains with a bigger time window. +7.28%

Reversal alerts: (11) filtered down to AZO PVH SNI FDO POWI & STMP. I already have PVH; nothing else is particularly compelling.

* The money here being mostly the money I had already invested.

Trades: FMCN nudged into the money. With the options expiring in eight days I could:

a) see if the breakout continues,

b) take the money (*) and run.

I chose B. Any profit is better than any loss, and I'm not here to gamble. I've got enough other positions where I can anticipate gains with a bigger time window. +7.28%

Reversal alerts: (11) filtered down to AZO PVH SNI FDO POWI & STMP. I already have PVH; nothing else is particularly compelling.

* The money here being mostly the money I had already invested.

Wednesday, January 12, 2011

Big Day

DNS +84, +21, +11.

Trades: see posts below.

Performance Chart (ordered by 2-week performance).

The value-sales portfolio is now up +51.25%.

Reversal alerts: (28). Almost nothing with significant sales growth. There were a number of value stocks that had very modest earnings growth like MSB APH & NBL. Nothing I want to invest in for a recovering economy. BBBY PCG WHR BMY and CL don't work for me here.

Trades: see posts below.

Performance Chart (ordered by 2-week performance).

The value-sales portfolio is now up +51.25%.

Reversal alerts: (28). Almost nothing with significant sales growth. There were a number of value stocks that had very modest earnings growth like MSB APH & NBL. Nothing I want to invest in for a recovering economy. BBBY PCG WHR BMY and CL don't work for me here.

+PTEN +PVH +UA

I ran a screen and after viewing the charts I selected PTEN and PVH.

PTEN is an energy stock with a P/E dropping from 67 to 19 with triple digit sales growth. Earnings estimates are nudging upward.

PVH is an apparel stock with a P/E falling from 281 to 27.5 and with triple digit sales growth for two quarters now. Its earnings estimates are on the rise too.

UA was a Shaeffer recommendation. The growth isn't spectacular, but the chart suggests that it's a safe place to buy.

I now have shares of PTEN and PVH, and call options for PTEN and UA.

AEIS probably started running 30 seconds after I sold it. Grrr.

PTEN is an energy stock with a P/E dropping from 67 to 19 with triple digit sales growth. Earnings estimates are nudging upward.

PVH is an apparel stock with a P/E falling from 281 to 27.5 and with triple digit sales growth for two quarters now. Its earnings estimates are on the rise too.

UA was a Shaeffer recommendation. The growth isn't spectacular, but the chart suggests that it's a safe place to buy.

I now have shares of PTEN and PVH, and call options for PTEN and UA.

AEIS probably started running 30 seconds after I sold it. Grrr.

-BIDU -AMAT -AEIS -SCHN

BIDU appeared to be topping out and couldn't muster a gain today so it got sold. calls: +17.8%, stock: +5.4% (held 8 days).

I chose to lighten up and sell call options for AMAT (+3.14%), AEIS (+0.62%), and SCHN (+5.65%).

I sold RES Jan $17.50 calls to convert my remaining calls to call spreads.

I chose to lighten up and sell call options for AMAT (+3.14%), AEIS (+0.62%), and SCHN (+5.65%).

I sold RES Jan $17.50 calls to convert my remaining calls to call spreads.

Cautious Me

Futures are indicating a huge open for the markets. If I were more pessimistic, I would sell into it, but instead I'll just hope this is the start of the next leg up. If not, I have the trailing stop loss orders in place.

No trades Monday.

Tuesday trades: I covered my short Jan $20 RES calls for a nickle. I plan to sell calls again before expiration.

Reversal alerts: (61) total between Monday and Tuesday.

Stocks showing strong earnings growth across the next two quarters but with a forward P/E > 20: ARBA PVH SLH ERES.

Stocks with some sales acceleration and a forward P/E < 20: See chart.

No trades Monday.

Tuesday trades: I covered my short Jan $20 RES calls for a nickle. I plan to sell calls again before expiration.

Reversal alerts: (61) total between Monday and Tuesday.

Stocks showing strong earnings growth across the next two quarters but with a forward P/E > 20: ARBA PVH SLH ERES.

Stocks with some sales acceleration and a forward P/E < 20: See chart.

Friday, January 7, 2011

No Fun Friday

It's official. I'm not enjoying this market any more. DNS -23 -7 -2.

Trades:

I bought ASML call options. I'm delighted because I didn't lose money there yet.

I bought RES calls based on the pre-market hint of a nice rebound. I'm delighted because I didn't lose more money there yet.

6% trailing stop loss orders triggered for stocks SMS and WLL. I saw that coming. +10.38% and +25.7% respectively.

Complaints Department:

SCHN missed and there went most of my nice profits in that. Grrr.

Reversal alerts:BLUD CRI SNI UCTT GPRO SYNO & THO. They're okay, but not compelling enough for this market.

The value sales port had a nice pop this week with nice gains by AUDC NVDA ONNN & CHK.

Trades:

I bought ASML call options. I'm delighted because I didn't lose money there yet.

I bought RES calls based on the pre-market hint of a nice rebound. I'm delighted because I didn't lose more money there yet.

6% trailing stop loss orders triggered for stocks SMS and WLL. I saw that coming. +10.38% and +25.7% respectively.

Complaints Department:

| |

| value-sales port +44.3% |

SCHN missed and there went most of my nice profits in that. Grrr.

Reversal alerts:BLUD CRI SNI UCTT GPRO SYNO & THO. They're okay, but not compelling enough for this market.

The value sales port had a nice pop this week with nice gains by AUDC NVDA ONNN & CHK.

Thursday, January 6, 2011

Was That a Fin?

Treading water is never any fun and you always think the worst. I like it better when my stocks go up 1-2% every day. Just set the trailing stops and let what happens happen.

Trades: See below. Also the $4.95 limit order for my Jan. $39/$44 CSTR spread sold. +109.8%

Other observations:

VSH is on the move again.

RES took a dump today. That's unfortunate because I have two Jan. call spreads. Both were a bit under water but recoverable. Not so much now.

Reversal alerts: (23) filtered down to CEPH LRCX BMS PRAA JDAS & MHK. CSTR also alerted but didn't make the cut with a forward P/E of 21.8. KEYN is also interesting with its P/E falling from 133 to 38.

Trades: See below. Also the $4.95 limit order for my Jan. $39/$44 CSTR spread sold. +109.8%

Other observations:

VSH is on the move again.

RES took a dump today. That's unfortunate because I have two Jan. call spreads. Both were a bit under water but recoverable. Not so much now.

Reversal alerts: (23) filtered down to CEPH LRCX BMS PRAA JDAS & MHK. CSTR also alerted but didn't make the cut with a forward P/E of 21.8. KEYN is also interesting with its P/E falling from 133 to 38.

-HAL +CSTR

I sold half of my BIDU calls (+20.3%) as I thought CSTR had more upside (and the BIDU position was oversized anyway). But the spread on CSTR calls was too much, so no trade there.

The HAL call options didn't pan out - gone. -31.3%

I canceled the IPHI buy and bought CSTR shares instead.

I rolled the VECO covered calls from $43 to $50.

The HAL call options didn't pan out - gone. -31.3%

I canceled the IPHI buy and bought CSTR shares instead.

I rolled the VECO covered calls from $43 to $50.

Wednesday, January 5, 2011

CSTR Basing

+ANR +YGE

Today's action was more like it. Indexes +32 +21 +6.

Trades: I bought ANR and YGE shares. ANR because of the 269-734% earnings growth which should drop the P/E from 69 to 26. YGE because of the growth and value (forward P/E falling below 7).

I had a limit buy in for IPHI - missed it.

My accounts are fully invested except for the money for the IPHI buy.

Reversal alerts: Most of these have very modest earnings growth, only CVGI is better in that respect but is not a bargain with a forward P/E of 55. The rest:BWS CRBL EXPE PETS MSFG UNFI CPSI KFRC HEI TYL CMG & ARM. Have fun diamond mining.

Trades: I bought ANR and YGE shares. ANR because of the 269-734% earnings growth which should drop the P/E from 69 to 26. YGE because of the growth and value (forward P/E falling below 7).

I had a limit buy in for IPHI - missed it.

My accounts are fully invested except for the money for the IPHI buy.

Reversal alerts: Most of these have very modest earnings growth, only CVGI is better in that respect but is not a bargain with a forward P/E of 55. The rest:BWS CRBL EXPE PETS MSFG UNFI CPSI KFRC HEI TYL CMG & ARM. Have fun diamond mining.

Tuesday, January 4, 2011

One Day Rally

Monday, January 3, 2011

New Year, New Money

It's good to see the money rolling in today after buying into so many positions last week in preparation for in-flows (IRA and otherwise). DJIA +93, Naz +39, SnP +14.

Friday's Trades: I rushed into a March call spread on IMAX on a buyout rumor (by Sony or Disney). Haste makes waste ('d money). My cost is low enough that this could turn out okay even if the buyout doesn't occur.

Monday's Trades: I sold Jan calls on VECO when it was up 4%+ to convert calls to a call spread. That increased my profit, took money off the table, lowered my cost, and lowered my risk by virtue of the two previous items. That's a win, win, win, win situation.

All of the shippers on my watch list were up today: EXM, FREE, FRO, NAT, PRGN, SSW, and TNP. SSW was the leader at +4.99% and is the only one I own. Do I expect this trend(*) to continue? No.

Reversal alerts:

Friday: (8) of which only ZAGG, BAX, and GRC are modestly interesting.

Monday: (19) filtered down to ...

growth stocks: LBAI, SMTC, ORCL, & DGICA. DGICA has something going on with their sales and earnings ramping up.

value only: AGP, GILD, MSFT, CEC, & CUB.

(*) One day does not make a trend!

Friday's Trades: I rushed into a March call spread on IMAX on a buyout rumor (by Sony or Disney). Haste makes waste ('d money). My cost is low enough that this could turn out okay even if the buyout doesn't occur.

Monday's Trades: I sold Jan calls on VECO when it was up 4%+ to convert calls to a call spread. That increased my profit, took money off the table, lowered my cost, and lowered my risk by virtue of the two previous items. That's a win, win, win, win situation.

| |

| value-sales portfolio, +37.3% (12/31) |

All of the shippers on my watch list were up today: EXM, FREE, FRO, NAT, PRGN, SSW, and TNP. SSW was the leader at +4.99% and is the only one I own. Do I expect this trend(*) to continue? No.

Reversal alerts:

Friday: (8) of which only ZAGG, BAX, and GRC are modestly interesting.

Monday: (19) filtered down to ...

growth stocks: LBAI, SMTC, ORCL, & DGICA. DGICA has something going on with their sales and earnings ramping up.

value only: AGP, GILD, MSFT, CEC, & CUB.

(*) One day does not make a trend!

Subscribe to:

Posts (Atom)